‘ACCELERATE‘ by EV2 Ventures is a multi-part article series on the smart mobility landscape in India. In the first edition, we outline our perspective on the evolving automotive market in India driven by the increasing focus on EV’s.

India, the world’s fourth-largest automobile market, is on the cusp of transformation to a cleaner and more sustainable mobility option through enabling electrification for vehicles.

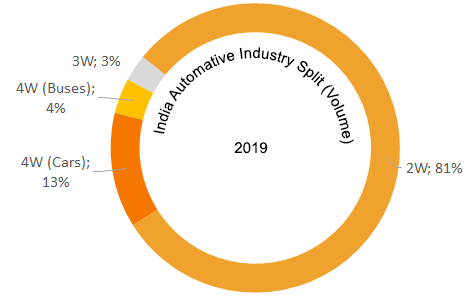

Conservatively, the Indian electric vehicle (EV) market size was estimated at 0.76 million units in 2019 and is expected to reach 5.6 million units (~USD $21 billion) by 2025 at a volume CAGR of ~40%, according to our internal analysis based on various reports including, among others Frost & Sullivan Mega Themes, Global EV Outlook by IEA and Enabling the Transition to Electric Mobility by FICCI. EVs accounted only for a mere 3% of the ~24 million automobiles sold in India during 2019, with the electric two-wheeler (2W) and electric three-wheeler (3W) segments displaying early adoption, capturing 97% of total EV sales during the same period.

High upfront cost and range anxiety have been paramount concerns for users; hence, we are witnessing a different trajectory across various segments, primarily based on use case. The Indian 2W and 3W markets, which are amongst the largest globally at ~84% of all vehicles on the road in India, have spearheaded the transition to electric vehicles. Currently, due to increased popularity across short-distance public transportation and commercial applications, 3Ws have been critical in paving the way for initial EV adoption. And, keeping in mind that 3Ws still mostly operate on lead-acid batteries (need to be replaced every 6 months) even though being considered, as the first movers in the EV space in India, are ripe for disruption, due to the transition towards more efficient and cleaner technologies. In like manner, we see proliferation of electric scooters (accounting for ~97% of total 2W electric sales in India), primarily for use in hyperlocal delivery. Owing to high utilization (meaning they are driven many kilometres in a given day), these segments are better positioned to benefit from the lower operating and maintenance cost of EVs, thereby resulting in a lower total cost of ownership (TCO).

High upfront cost and range anxiety have been paramount concerns for users; hence, we are witnessing a different trajectory across various segments, primarily based on use case. The Indian 2W and 3W markets, which are amongst the largest globally at ~84% of all vehicles on the road in India, have spearheaded the transition to electric vehicles. Currently, due to increased popularity across short-distance public transportation and commercial applications, 3Ws have been critical in paving the way for initial EV adoption. And, keeping in mind that 3Ws still mostly operate on lead-acid batteries (need to be replaced every 6 months) even though being considered, as the first movers in the EV space in India, are ripe for disruption, due to the transition towards more efficient and cleaner technologies. In like manner, we see proliferation of electric scooters (accounting for ~97% of total 2W electric sales in India), primarily for use in hyperlocal delivery. Owing to high utilization (meaning they are driven many kilometres in a given day), these segments are better positioned to benefit from the lower operating and maintenance cost of EVs, thereby resulting in a lower total cost of ownership (TCO).

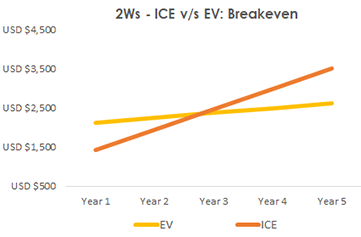

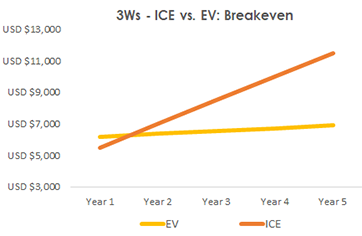

Over a 5-year period, the TCO of electric 2Ws & 3Ws is lower than conventional Internal Combustion Engine (ICE) vehicles for commercial use cases. However, the same cannot be achieved currently for passenger applications due to the combination of lower utilization rates, the absence of robust charging network, and higher average cost when compared to an ICE vehicle. A 2W has typical cost savings of ~USD $900 while a 3W has ~USD $4,500 over a comparable ICE 2W or 3W vehicle respectively, from a 5-year outlook. To put the savings in perspective, on average the total cost savings on an EV 2W and 3W vehicle cumulatively over 5-years is roughly equivalent to the upfront cost of the entire ICE vehicle.

On the other hand, the electric four-wheeler (4W) market, comprising passenger cars and buses, is still in its infancy. While there is some early traction in the commercial segment, apprehension remains on account of the battery size – resulting in a significantly higher purchase price. A traditional ICE bus typically costs ~USD $50,000 while an electric bus costs 6-7x more, with lack of charging infrastructure compounding the problem. Due to similar concerns, the passenger car market is yet to make meaningful inroads in the country.

Startups are playing a pivotal role in developing the electric vehicle ecosystem in India, by indigenously developing battery and drivetrain technologies.

Startups are playing a pivotal role in developing the electric vehicle ecosystem in India, by indigenously developing battery and drivetrain technologies.  Ather Energy, Gugu Energy, Ultraviolette, Tork Motors, Battre, Okinawa Scooters are some of the many startups driving the EV 2W segment along with established institutional players like TVS, Bajaj, Hero Electric etc. with the Indian 3W market being driven by design-build manufacturers such as Gayam Motor Works, Kinetic Green, Euler Motors and Mahindra Electric. The key driving force behind early adoption across these two segments is the average breakeven point, compared to the cost of a comparable ICE vehicle, of around 2 years for 2W and 3W when used in commercial applications.

Ather Energy, Gugu Energy, Ultraviolette, Tork Motors, Battre, Okinawa Scooters are some of the many startups driving the EV 2W segment along with established institutional players like TVS, Bajaj, Hero Electric etc. with the Indian 3W market being driven by design-build manufacturers such as Gayam Motor Works, Kinetic Green, Euler Motors and Mahindra Electric. The key driving force behind early adoption across these two segments is the average breakeven point, compared to the cost of a comparable ICE vehicle, of around 2 years for 2W and 3W when used in commercial applications.

With the overall EV landscape slowly solidifying and addressing of the various consumer concerns, we are witnessing improvements in battery technology, driving range, design capabilities as well as increased local capabilities pertaining to production and assembly.

In addition to consumers, a perception shift in the investment community is also noticeable. According to various transaction databases – in 2019, the EV space in India attracted investments worth ~USD $776 million (accounting for more than 50% of global investment value) compared to merely ~USD $16 million in 2015. Even the average investment value has expanded from an average transaction size of ~USD $2 million in 2015 to ~USD $22 million in 2019.

An increased volume and value of investment sizes is imperative in order to help India create a competitive edge in the global EV market. Globally, the EV market is valued at ~USD $162 billion (Source: Valuates) and is dominated by players such as Tesla, BYD, SAIC, Nissan, BMW, Volkswagen etc. Investors have already evinced keen interest in start-ups across the world, for example Rivian, which has raised over USD $5 billion till date even prior to its commercial launch in 2021. While China leads the pack in EV sales volume globally, Norway has the highest EV penetration (30%+) across the world. Both these countries have been able to set successful examples for electrification with the right combination of infrastructure development, enhanced battery technologies and government assistance.

Now, companies across the world are concentrating on sustainable profitability and in the process, several of them are opting for electrification – DHL is planning to use clean transportation for 70% of its delivery operations by 2025, IKEA & Unilver have also announced 100% electric fleets by 2030. Additionally, even in India, delivery fleets of Amazon, Flipkart, BigBasket are increasingly shifting their operations to EVs. While there is a social governance angle to these changes, there is also a large financial incentive, since EVs have lower per kilometre delivery costs and in general lower maintenance costs.

To make the most of the favorable demand and investment environment, Indian players need to create long term sustainable local manufacturing capabilities –and, the current pandemic has, more than ever, underscored the need for geographical diversity in supply chains. Collaboration between large OEMs and startups could also benefit the entire ecosystem with one bringing manufacturing expertise and the other offering technological dexterity respectively. Hero MotoCorp’s investment in Ather is one such example.

Keeping in mind that India has a target of achieving 30% EV penetration by 2030, this is one of the most dynamic phases of the Indian automotive sector – one that requires careful calibration and a supportive ecosystem for successful transition.

In conclusion, we believe that the initial successes, and the potential for sustainable value creation, in the EV sector in India will be in high utilization environments, including logistics, supply-chain, hyper local delivery, and shared mobility spaces. Smart mobility, in this sense, is the application of technology to venture scale problems where financial viability is demonstrable to customers from the beginning.

Contact Us: We welcome all friends of Ev2 Ventures to reach out for an open discussion and we are just an email away for any inquiries or clarifications – Email: [email protected]