‘ACCELERATE’ by EV2 Ventures is a multi-part article series on the smart mobility landscape in India. This is the third edition in which we analyze the dynamics of the logistics sector in India.

While logistics and supply chain have always been the backbone for any country’s growth, the Covid-19 pandemic has emphasized their importance like never before. This period has exposed limitations in the supply chain and passenger transportation system across the globe including India.

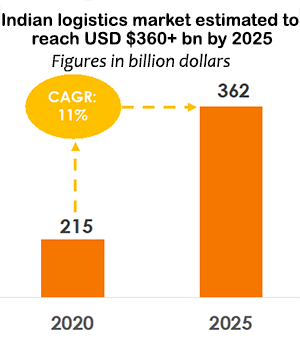

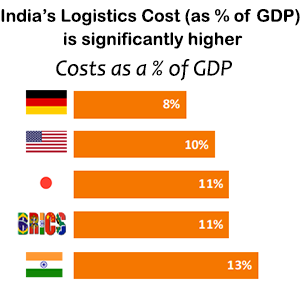

The Indian logistics market, currently valued at USD $215 billion (Based on estimates of economic survey conducted in 2017-18), is highly unorganized, disconnected and heavily reliant on analog processes — As a result, India’s logistics costs stand at 13-14% (As per report by Arthur D. Little India

The Indian logistics market, currently valued at USD $215 billion (Based on estimates of economic survey conducted in 2017-18), is highly unorganized, disconnected and heavily reliant on analog processes — As a result, India’s logistics costs stand at 13-14% (As per report by Arthur D. Little India  released in collaboration with CII) of GDP as compared to an average of 10% in US, Germany, Japan and other BRIC nations. Though, the government is targeting to bring down that cost to <10% over the next few years, but it seems to be a daunting task until the industry embraces robust technology intervention. Historically, the pace of technology adoption has been sluggish, even though the industry understands the need of capable technology to help transform the disjointed supply chain into a connected ecosystem. The delivery of goods from the manufacturer to the end consumer is often a lengthy process and involves a multi-step journey which includes (1) Plant & First mile Logistics, (2) Mid mile Logistics and (3) Last mile delivery. Supply chain management professionals are required to make this journey as efficient and cost effective as possible. Lately, we have seen that last mile delivery services have garnered keen interest, largely driven by extensive e-commerce adoption.

released in collaboration with CII) of GDP as compared to an average of 10% in US, Germany, Japan and other BRIC nations. Though, the government is targeting to bring down that cost to <10% over the next few years, but it seems to be a daunting task until the industry embraces robust technology intervention. Historically, the pace of technology adoption has been sluggish, even though the industry understands the need of capable technology to help transform the disjointed supply chain into a connected ecosystem. The delivery of goods from the manufacturer to the end consumer is often a lengthy process and involves a multi-step journey which includes (1) Plant & First mile Logistics, (2) Mid mile Logistics and (3) Last mile delivery. Supply chain management professionals are required to make this journey as efficient and cost effective as possible. Lately, we have seen that last mile delivery services have garnered keen interest, largely driven by extensive e-commerce adoption.

Last mile logistics commences from picking up the goods from the final processing center or warehouse and delivering to the end consumer in a couple of days. Huge transformation across this segment lately has been seen due to the impact of COVID-19, which has accelerated the overall consumer behavior and the retail ecosystem – whereby the hyperlocal delivery for essential goods has grown by 3x (As reported by Indian Transport & Logistics News) and over 80% consumers are expecting same day delivery. Although this has highlighted the need for more robust delivery mechanism in the country few startups have now adopted technology and reworked fulfilment processes to help trim their delivery time from a couple of days to a couple of hours. Nevertheless, the competition is getting intense with large e-commerce players such as — Bigbasket, Grofers, Licious, Flipkart Supermarket, Dmart, JioMart etc. entering the hyperlocal delivery segment with Amazon like SLA’s. There are more than 12 million Kirana stores in the country which are becoming the cornerstone of the growth plans for those retail giants. They are now transforming from brick & mortar form to quasi-digital businesses which implies that there is little room for error in the current business environment. Several players are now experimenting with new business models through strategic tie-ups. For instance, Paytm mall has tied up with 10,000+ Kirana stores to enable grocery deliveries and on the other hand, Flipkart has partnered with retail store chain, Vishal Mega mart for home delivery of essentials.

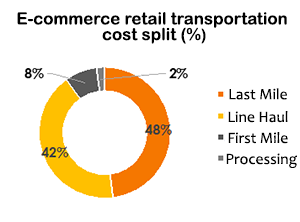

Mid mile (“Line haul”) logistics is another leg which is equally important to the last mile delivery segment. Unlike consumer facing businesses, Mid mile is seldom visible to the end consumer but has a significant relevance in the logistics supply chain. It includes movement of goods from the warehouse to the distribution/retail center for last mile delivery. Though, there are few challenges, such as lack of live tracking mechanisms, empty miles, paperwork, poor routing, etc., that are now cropping up due to the rapid rise in importance of e-commerce & online retail industry. These problems are plaguing the transporters and shippers alike and lead to high logistics costs & operational inefficiencies. In an e-commerce retail setup, Mid mile logistics cost contributes to around 42% (As per KPMG report on E-commerce retail logistics in India) of the total processing cost which is critical for any businesses decision making process. Technologies that enable real-time feedback, enhance route optimization and provide return trip visibility, help prevent cost escalation.

Mid mile (“Line haul”) logistics is another leg which is equally important to the last mile delivery segment. Unlike consumer facing businesses, Mid mile is seldom visible to the end consumer but has a significant relevance in the logistics supply chain. It includes movement of goods from the warehouse to the distribution/retail center for last mile delivery. Though, there are few challenges, such as lack of live tracking mechanisms, empty miles, paperwork, poor routing, etc., that are now cropping up due to the rapid rise in importance of e-commerce & online retail industry. These problems are plaguing the transporters and shippers alike and lead to high logistics costs & operational inefficiencies. In an e-commerce retail setup, Mid mile logistics cost contributes to around 42% (As per KPMG report on E-commerce retail logistics in India) of the total processing cost which is critical for any businesses decision making process. Technologies that enable real-time feedback, enhance route optimization and provide return trip visibility, help prevent cost escalation.

Keeping in mind that multiple start-ups such as Blackbuck, Delhivery, Rivigo etc have evolved into unicorns and now with the Indian Government granting Infrastructure status to logistics in India, the space continues to attract investments with over USD $2 billion investments (As per Venture Intelligence & Tracxn database) in last 2 years which is gaining momentum over the years as compared to the mere USD $77 million of investment in 2014. Additionally, the introduction of the e-way bill & the government’s plan to pump in USD $75 billion (As per announcement of GOI under the ambitious Bharatmala Pariyojana) in development of road infrastructure in the country will give a huge boost to businesses dependent on road transportation.

Additionally, to further streamline supply chain, the focus should not just be on last mile and mid mile, but the industry should also emphasize plant & first mile logistics, as it facilitates movement of goods from factory/plant to distribution center, where mid and last mile logistics takes over. Inefficiencies across this segment create incorrect detailing, packaging, delay at plant, congestion, yard pilferage challenges, which result in a spiraling effect across the ecosystem for the buyers and shippers alike. India losses approximately USD $20 billion (Based on a study conducted by TCI in collaboration with IIM-Kolkata) each year due to road transit delays and accounts for 64% (As per BSI & TT Club Cargo Theft Report) of Asia’s cargo theft (2019). Therefore, companies are required to have integration of such technology to the system which can manage their plant/yard and first mile field logistics efficiently. Players such as Enmovil are attempting to address these issues through a robust unified solution, that help provide insights regarding gate congestion, loading / unloading delays, mishandling etc.

In this unpredictable environment, companies are increasingly relying on AI and data analytics to enhance efficiency and improve real-time decision making. Startups such as Shadowfax, Trukky, MoveInSync, Yoryo etc. are attempting to utilize robust technologies to enable booking automation, route optimization and reduction of empty miles. Separately, businesses are also looking to optimize costs through mass adoption of electric vehicle fleets for cargo & passenger movement. (See our concept note on EV’s)

We believe that as businesses start to recognize logistics as more than just a cost center, they will have to consider agility as the new normal because first mile & mid mile logistics are as critical as last mile logistics in the entire supply chain. The need of the hour is to optimize the whole supply chain system but digitization by itself is unlikely to address all the issues – utilization of technology and continuous innovation is critical. Today’s environment has provided us the opportunity to re-evaluate the future of the logistics & transportation industry – shifting our approach from reactive to proactive to make the system more resilient and effective is likely to yield more success in the future.

Contact Us: We welcome all friends of Ev2 Ventures to reach out for an open discussion and we are just an email away for any inquiries or clarifications – Email: Team@Ev2.vc