‘ACCELERATE‘ by EV2 Ventures is a multi-part article series on the smart mobility landscape in India. This is the second edition in which we analyze technology’s potential to transform the Indian agricultural supply chain.

The Gross value added by Indian agricultural and related industries is estimated to be ˜US$ 276 Bn in FY20 – accounting for ~15% of India’s GDP. This sector has been the key economic pillar for the country, with agriculture being the mainstay of livelihood for more than 60% of the Indian rural population, compared to 2% in USA and 10% in other Asian countries. Demand for agri-products has always been secular but the supply side is constrained with myriad challenges across every step of the value chain – pre-harvest, harvest and post-harvest.

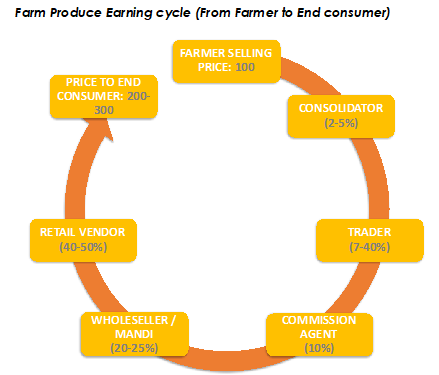

Despite having the 2nd largest arable land in the world, India’s yield per hectare is still ~40% less than other Asian countries which is mainly caused by restricted access to quality seeds and fertilizers, small land holdings, limited mechanization and automation, lengthy supply chain with multiple middlemen between the farmer and the end consumer. The supply chain inefficiencies, combined with a lack of sufficient cold storage infrastructure, contribute to substantial wastage of agricultural products and perpetuate a lack of transparent and fair pricing. India’s post-harvest losses, in the fruits & vegetable category alone, amount to US$ 20 billion per annum.

Despite having the 2nd largest arable land in the world, India’s yield per hectare is still ~40% less than other Asian countries which is mainly caused by restricted access to quality seeds and fertilizers, small land holdings, limited mechanization and automation, lengthy supply chain with multiple middlemen between the farmer and the end consumer. The supply chain inefficiencies, combined with a lack of sufficient cold storage infrastructure, contribute to substantial wastage of agricultural products and perpetuate a lack of transparent and fair pricing. India’s post-harvest losses, in the fruits & vegetable category alone, amount to US$ 20 billion per annum.

New age entrepreneurs are bringing technological innovation to the sector in an attempt to address these challenges and unlock value across the supply chain. The agri start-up ecosystem in India is mushrooming with 450+ start-ups that are currently operational, and over 50% focused on making the supply chain more efficient. Investors are increasingly showing interest in the space and according to a recent report on agritech, the segment attracted venture investments to the tune of ~US$ 250 million in 2019 and is estimated to grow to US$ 500 million over the next 2 years.

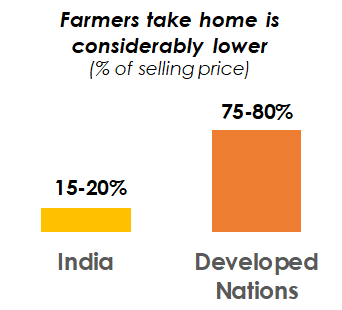

Indian farmers in aggregate incur ~US$ 13 billion per year in post-harvest losses (spoilage of produce on the farm), primary causes of which are poor storage facilities and expensive and  unreliable transportation. Further, the take home earning percentage of Indian farmers is very low accounting for only 15- 20% of the end consumer selling price. In developed countries, the take home percentage is multiple times higher at approximately 70-80%. Improving market linkages – at pre-harvest stage (i.e. by creating access to quality fertilizers, seeds, equipment etc.) and post-harvest stage (by establishing seamless conections with marketplaces, retailers etc.) will have a substantial impact on the value chain. A number of start-ups, including BigHaat, Gramophone, Freshokartz, Agrostar are providing access to quality inputs to farmers while players such as Ninjacart, Crofarm, Waycool etc. are connecting farmers with buyers. Such solutions are providing demand discovery and transparent pricing in addition to improved crop yield. Combined demand discovery and increased crop yield can increase farmer income by ~50%. Over time, as farmers witness tangible outcomes from using modern technologies adapted to the agricultural sector, we expect to see increased adoption of such innovative models, which should help to streamline the entire industries supply chain process.

unreliable transportation. Further, the take home earning percentage of Indian farmers is very low accounting for only 15- 20% of the end consumer selling price. In developed countries, the take home percentage is multiple times higher at approximately 70-80%. Improving market linkages – at pre-harvest stage (i.e. by creating access to quality fertilizers, seeds, equipment etc.) and post-harvest stage (by establishing seamless conections with marketplaces, retailers etc.) will have a substantial impact on the value chain. A number of start-ups, including BigHaat, Gramophone, Freshokartz, Agrostar are providing access to quality inputs to farmers while players such as Ninjacart, Crofarm, Waycool etc. are connecting farmers with buyers. Such solutions are providing demand discovery and transparent pricing in addition to improved crop yield. Combined demand discovery and increased crop yield can increase farmer income by ~50%. Over time, as farmers witness tangible outcomes from using modern technologies adapted to the agricultural sector, we expect to see increased adoption of such innovative models, which should help to streamline the entire industries supply chain process.

Separately, developing adequate storage infrastructure is also vital for reducing post-harvest losses, and maintaining long term agri supply chain efficiency. India’s agri-storage capacity is estimated at ~162 million metric tonnes out of which cold chain capacity is ~30-35 million metric tonnes – with more than 50% of cold chain facilities consisting of single commodity storages (mainly potato) with dated technology systems. Upcoming players such as Ecozen are attempting to address this by offering portable cold rooms on lease, thereby, assisting with on-farm cooling at an affordable cost.

Separately, developing adequate storage infrastructure is also vital for reducing post-harvest losses, and maintaining long term agri supply chain efficiency. India’s agri-storage capacity is estimated at ~162 million metric tonnes out of which cold chain capacity is ~30-35 million metric tonnes – with more than 50% of cold chain facilities consisting of single commodity storages (mainly potato) with dated technology systems. Upcoming players such as Ecozen are attempting to address this by offering portable cold rooms on lease, thereby, assisting with on-farm cooling at an affordable cost.

Further, Precision farming techniques, enabled by IoT and AI, collect farm data to provide predictive insights and enhance decision-making in real time. Players like CropIn, Fasal, and Aibono are offering a wide variety of solutions using analytics, sensors and vision-based systems. However, farmer’s willingness to adopt & pay for these technologies could be a constraint initially as there are basic technology applications that can have substantial impact on crop yields and farmer incomes. Training combined with, affordable financing models, such as subscription and rent based models, may pave the way to encourage wide-spread adoption of technologies at reduced upfront costs.

New players are utilizing novel technologies to plug numerous inefficiencies plaguing the sector; however, multiple factors are hindering adoption. At the outset, changing farmer perception is crucial. Businesses need to invest in building strong on-ground community networks on both demand and supply side, in order to ensure sustainable traction. This sales process is time consuming due to rural infrastructure, and the number of small farmers involved in the sector.

Several global players are beginning to realize the potential of the Indian agricultural market and are engaging with startups to help them expand their reach. Early this year, Microsoft launched a program for agritech startups to support them with technology, business & marketing tools. Similarly, Bayer partnered with Agribazaar to assist farmers with technology transfers and advisory services.

The current pandemic, like never before, has exposed the gaps in our current system and tested the functionality of existing business models. The pandemic lockdown resulted in abandoned harvest & waste of foods due to lack of proper supply chain, agri related advisory & poor storage/warehousing facilities in the economy. The crisis caused both demand & supply side bottlenecks & impacted the life of a large number of agri farmers & traders.

Keeping the above in mind a few startups have stepped up to redesign the farming ecosystem with the focus to eliminate the multi-step middle-men distribution system, the inefficiencies of which eat most of the farmer’s income. This include, Hydroponic (soil less) farming, smart/robotics farming using IOT/AI/ML based technology & Digitizing the supply chain network to curb any kind of unfair selling of the farm produce.

We believe that this is the right time for startups to seize the opportunity in this sector and focus on providing sophisticated solutions that can help in building an integrated, resilient supply chains & smart farming ecosystem for a self-reliant future.

Contact Us: We welcome all friends of Ev2 Ventures to reach out for an open discussion and we are just an email away for any inquiries or clarifications – Email: Team@Ev2.vc